| Title |

Miscellaneous |

| Description |

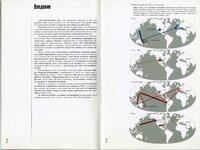

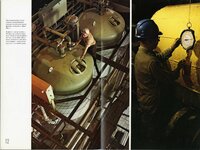

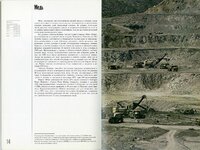

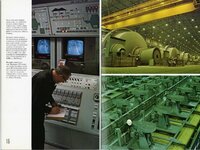

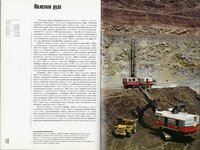

This collection contains a copy of speeches given by E.W. Littlefield from 1952-1997. Of interest is a report on Utahs Mining in Russia and a photograph with accompanying text about the company owned ranches in Montello, NV. |

| Subject |

Littlefield, Edmund W. (Edmund Wattis), 1914-2001; Speeches; Correspondence; Stanford University; San Francisco (Calif.); Utah International Inc.; General Electric Corporation |

| Digital Publisher |

Stewart Library, Weber State University, Ogden, Utah, USA |

| Date Digital |

2010 |

| Temporal Coverage |

1952; 1953; 1954; 1955; 1956; 1957; 1958; 1959; 1960; 1961; 1962; 1963; 1964; 1965; 1966; 1967; 1968; 1969; 1970; 1971; 1972; 1973; 1974; 1975; 1976; 1977; 1978; 1979; 1980; 1981; 1982; 1983; 1984; 1985; 1986; 1987; 1988; 1989; 1990; 1991; 1992; 1993; 1994; 1995; 1996; 1997 |

| Item Description |

a 28 page booklet, along with a few miscellaneous pages, and a photo |

| Spatial Coverage |

San Francisco, San Francisco County, California, United States, http://sws.geonames.org/5391959, 37.77493, -122.41942 |

| Type |

Text; Image/StillImage |

| Conversion Specifications |

Archived TIFF images were scanned with an Epson Expression 10000XL scanner. JPG and PDF files were then created for general use. |

| Language |

eng |

| Relation |

https://archivesspace.weber.edu/repositories/3/resources/290 |

| Rights |

Materials may be used for non-profit and educational purposes; please credit Special Collections Department, Stewart Library, Weber State University. |

| Sponsorship/Funding |

Funded through the generous support of the Edmund W. and Jeannik M. Littlefield Foundation. |

| Source |

MS 155 Box 1-5 Weber State University Special Collections |

| Format |

application/pdf |

| ARK |

ark:/87278/s6dhm9cq |

| Setname |

wsu_ucc_ed |

| ID |

39320 |

| Reference URL |

https://digital.weber.edu/ark:/87278/s6dhm9cq |

| Title |

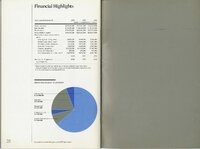

003_16 September 1975 Shareholder Quarterly Report - 037_page1 |

| Description |

This collection contains a copy of speeches given by E.W. Littlefield from 1952-1997. Of interest is a report on Utahs Mining in Russia and a photograph with accompanying text about the company owned ranches in Montello, NV. |

| Subject |

Littlefield, Edmund W. (Edmund Wattis), 1914-2001; Speeches; Correspondence; Stanford University; San Francisco (Calif.); Utah International Inc.; General Electric Corporation |

| Date Digital |

2010 |

| Type |

Text; Image/StillImage |

| Language |

eng |

| Rights |

Materials may be used for non-profit and educational purposes; please credit Special Collections Department, Stewart Library, Weber State University. |

| Source |

MS 155 Box 1-5 Weber State University Special Collections |

| Format |

application/pdf |

| Setname |

wsu_ucc_ed |

| ID |

39922 |

| Reference URL |

https://digital.weber.edu/ark:/87278/s6dhm9cq/39922 |