| Title |

2006-1 Partners for Progress-Uncommon Vision Keepsake |

| Creator |

Weber State Univesity |

| Contributors |

Utah Construction Company/Utah International |

| Description |

The WSU Stewart Library Annual UC-UI Symposium took place from 2001-2007. The collection consists of memorabilia from the symposium including a yearly keepsake, posters, and presentations through panel discussions or individual lectures. |

| Subject |

Littlefield, Edmund W. (Edmund Wattis), 1914-2001; Eccles, Marriner S. (Marriner Stoddard), 1890-1977; Utah Construction Company; Utah International Inc. |

| Digital Publisher |

Stewart Library, Weber State University, Ogden, Utah, USA |

| Date Original |

2006 |

| Date |

2006 |

| Date Digital |

2008 |

| Temporal Coverage |

2001; 2002; 2003; 2004; 2005; 2006; 2007 |

| Item Size |

7 inch x 7 inch |

| Medium |

books |

| Item Description |

92 page paperback book |

| Type |

Text; Image/StillImage |

| Conversion Specifications |

Archived TIFF images were scanned with an Epson Expression 10000XL scanner. Digital images were reformatted in Photoshop. JPG and PDF files were then created for general use. |

| Master Quality |

400 PPI |

| Language |

eng |

| Relation |

https://archivesspace.weber.edu/repositories/3/resources/212 |

| Rights |

Materials may be used for non-profit and educational purposes; please credit Special Collections Department, Stewart Library, Weber State University. |

| Source |

HD9715.U54U88 2006 Special Collections, Stewart Library, Weber State University |

| Format |

application/pdf |

| ARK |

ark:/87278/s6ksyej5 |

| Setname |

wsu_ucui_sym |

| ID |

97633 |

| Reference URL |

https://digital.weber.edu/ark:/87278/s6ksyej5 |

| Title |

2006_047_page84and85 |

| Creator |

WSU Stewart Library |

| Image Captions |

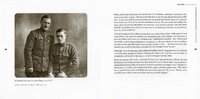

Alexander Wilson, left, succeeded Ed Littlefield as president and general manager, while Littlefield succeeded Marriner Eccles as chairman of the Board of Directors. Eccles was named honorary chairman. |

| Description |

The WSU Stewart Library Annual UC-UI Symposium took place from 2001-2007. The collection consists of memorabilia from the symposium including a yearly keepsake, posters, and presentations through panel discussions or individual lectures. |

| Subject |

Edward Littlefield, Marriner Eccles, Ogden-Utah, Utah Construction Company, Utah International |

| Date Original |

2006 |

| Date |

2006 |

| Date Digital |

2008 |

| Item Description |

92 page paperback book |

| Type |

Text; Image/StillImage |

| Conversion Specifications |

Archived TIFF images were scanned with an Epson Expression 10000XL scanner. Digital images were reformatted in Photoshop. JPG and PDF files were then created for general use. |

| Master Quality |

400 PPI |

| Language |

eng |

| Rights |

Materials may be used for non-profit and educational purposes; please credit Special Collections Department, Stewart Library, Weber State University. |

| Source |

HD9715.U54U88 2006 Special Collections, Stewart Library, Weber State University |

| Format |

application/pdf |

| Setname |

wsu_ucui_sym |

| ID |

97907 |

| Reference URL |

https://digital.weber.edu/ark:/87278/s6ksyej5/97907 |