| Title |

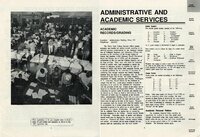

1988-1989 Weber State College Catalog |

| Creator |

Weber State College |

| Description |

This collection consists of copies of annual catalogs issued by Weber State College from 1963 to 1991. The college was affiliated with the Church of Jesus Christ of Latter-day Saints until 1933, when it was turned over to the state. |

| Subject |

State boards of education; Universities and colleges--Curricula--Catalogs; Faculty; Ogden (Utah); Weber State College |

| Digital Publisher |

Stewart Library, Weber State University, Ogden, Utah, USA |

| Date Original |

1988; 1989 |

| Date |

1988; 1989 |

| Date Digital |

2013 |

| Item Description |

5.6 X 8-11 X 8 inch |

| Conservation Notes |

paperback book |

| Type |

Text |

| Conversion Specifications |

Archived TIFF images were scanned with an Epson Expression 10000XL scanner. Digital images were reformatted in Photoshop. JPG and PDF files were then created for general use. |

| Master Quality |

300 PPI |

| Language |

eng |

| Rights |

Public Domain. Courtesy of University Archives, Stewart Library, Weber State University |

| Source |

LD 5893.W5C32 Weber State University Archives |

| Format |

application/pdf |

| ARK |

ark:/87278/s62903yw |

| Setname |

wsu_cat |

| ID |

19934 |

| Reference URL |

https://digital.weber.edu/ark:/87278/s62903yw |

| Title |

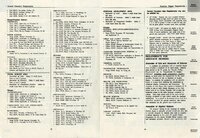

Page 110 and Page 111 |

| Creator |

Weber State College |

| Description |

This collection consists of copies of annual catalogs issued by Weber State College from 1963 to 1991. The college was affiliated with the Church of Jesus Christ of Latter-day Saints until 1933, when it was turned over to the state. |

| Subject |

State boards of education; Universities and colleges--Curricula--Catalogs; Faculty; Ogden (Utah); Weber State College |

| Digital Publisher |

Stewart Library, Weber State University, Ogden, Utah, USA |

| Date Original |

1988; 1989 |

| Date |

1988; 1989 |

| Date Digital |

2013 |

| Item Description |

5.6 X 8-11 X 8 inch |

| Conservation Notes |

paperback book |

| Type |

Text |

| Conversion Specifications |

Archived TIFF images were scanned with an Epson Expression 10000XL scanner. Digital images were reformatted in Photoshop. JPG and PDF files were then created for general use. |

| Master Quality |

300 PPI |

| Language |

eng |

| Rights |

Public Domain. Courtesy of University Archives, Stewart Library, Weber State University |

| Source |

LD 5893.W5C32 Weber State University Archives |

| Format |

application/pdf |

| Setname |

wsu_cat |

| ID |

33035 |

| Reference URL |

https://digital.weber.edu/ark:/87278/s62903yw/33035 |